- Blog

- Fraud Prevention Doesn’t Kill Growth, Multi-Accounting Does

Fraud Prevention Doesn’t Kill Growth, Multi-Accounting Does

Fraud prevention can sometimes be looked at as a growth killer, but in reality, it's a growth enabler. By curbing multi-accounting, fraud prevention has the power to improve the quality of new user acquisitions.

Subscribe to the Incognia Newsletter

A healthy, growing user base is the backbone of any successful platform. Promoting growth and new user acquisitions is always a high-priority goal, but unfortunately, the incentives that attract new customers also attract fraudsters and other bad actors. In this post, we’ll take a look at multi-accounting, the effects it has on your platform, and how to manage it without hurting your growth strategy.

Key TakeAways

- Multi-accounting skews key metrics and decreases the effectiveness of marketing campaigns

- Framing conversations with the marketing team in terms of customer lifetime value can be a helpful way to communicate fraud prevention's benefits

- Limiting fake accounts allows promotional budgets to go further and to reach more genuine users

The real cost of unchecked multi-accounting

If fraudsters just made dozens of fake accounts and never used them, maybe it wouldn’t be such a critical issue.

But that’s not what they do.

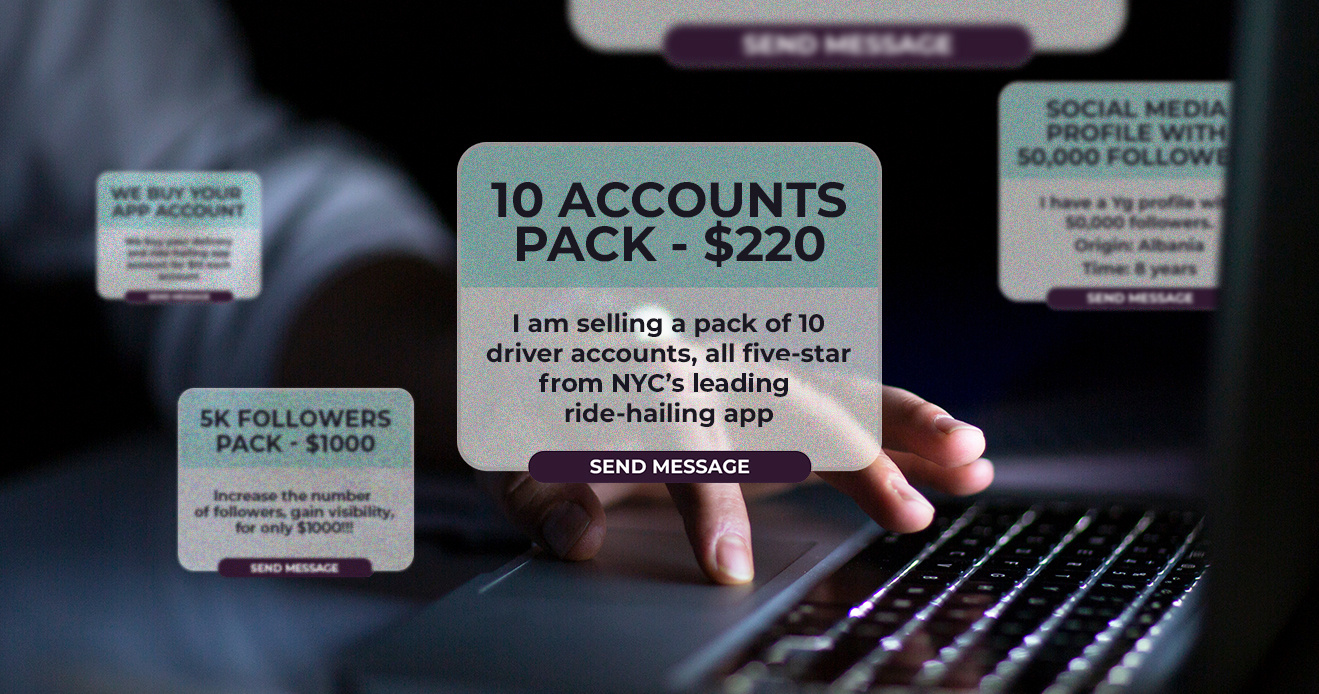

Fraudsters make dozens of fake accounts so they can use them for ban evasion, social engineering, refund abuse, promo abuse, collusion, and more. Having a bank of other accounts to rely on lets them scale their fraud operations and evade accountability—there’s less risk in getting banned if you have another account you can use, after all.

As Incognia’s Global Head of Industry, Eduardo Pires, once said: “If you have fake accounts, you can do pretty much any type of scam.”

In a webinar with Incognia called “Multi-Accounting: The Gateway to Marketplace Fraud,” Glovo’s Head of Operations Faisal Ahmad Jarif explained that multi-accounting negatively impacts your understanding of your own platform:

“Multi-accounting actually impacts marketplace operations massively as it disturbs some of the core and key metrics.

For example, total number of downloads of your app, active customer base, average spending by a customer on the platform. Because what you feel is your active customer base may not actually be a unique customer base, but some of the customers may be actually having duplicate accounts. So, these are the metrics that do all your growth metrics, all your customer churn metrics, retention metrics, et cetera.

They can be completely disturbed if you do not know what your exact or unique customer base is, and multi-accounting really impacts your business altogether.”

Multiple accounts means a wider attack surface for fraudsters and a harder time getting rid of them once they’ve been caught.

But taking measures against multi-accounting can sometimes get pushback from growth-focused teams like marketing. Changing the structure of new user incentives and trying to implement more friction in onboarding can be controversial tactics if not explained properly.

Getting buy-in from other teams in your organization means framing the story in a way that explains the long-term growth benefits of tackling multi-accounting at the source.

Customer lifetime value (CLV)

In the same webinar, Faisal gave some advice on how to approach your growth team about the benefits of fraud prevention:

“I'll give you a practical example. I have always worked with a growth team very closely and how I have tackled this problem is by showing them the life cycle or the lifetime value of a customer. If you are in a customer growth spree, but there are specific cohorts of new customers that have a very poor customer lifetime value, I think that is the way you can convince the growth team that this is a cohort of customers that is not adding any value to the business, but rather they are draining your P&L.

Brian Hiebert, Senior Fraud Operations Manager at Just Eat Takeaway, added onto this point:

“You know, the last thing that your marketing team wants to see is that you're throwing this money at new customers and promotions are being utilized, but then none of those customers come back, which indicates that it's just a fake account created just to utilize the new customer voucher.”

When you put measures in place to stop multi-accounting, your promotion budgets and user acquisition efforts go towards users who have a chance of actually staying with the platform and converting multiple times. That’s a more substantial definition of growth than the number of user accounts rising because of fraudsters creating fake accounts en masse.

Better fraud prevention doesn’t have to hurt good user growth

There are ways to focus our fraud prevention efforts healthily and strategically to minimize friction on low-risk users. Faisal mentions this idea of strategic or “healthy” friction in the webinar:

“If you recognize that you have a multi-accounting issue, then you need to build guardrails at the onboarding stage. And you need to find that sweet spot where your growth is not curtailed, but at the same time, you can build some friction, which I would say is healthy friction for your bad actors, so that their entry to the platform can be reduced.”

One way to target friction is by using passive risk assessments at onboarding. Using Incognia as an example, one of the layers of our three-layered solution is tamper detection. We perform device integrity checks at onboarding and look for the presence of emulators, app cloners, location spoofing apps, app tampering tools, and more.

The presence of any of these tools makes it more likely that that user has bad intentions on the platform, and so that might be a case where you would want to apply a little more friction to the onboarding process.

Fraud prevention measures against multi-accounting can sound growth limiting on the surface, but when you frame your efforts from the perspective of maintaining key metrics and improving CLV, you can communicate your team's value to the rest of your organization.