- Blog

- Marketplace Fraud: A Comprehensive Guide to Protect Your Platform and Customers

Marketplace Fraud: A Comprehensive Guide to Protect Your Platform and Customers

In the cyber world, marketplace fraud continues to be a pressing issue, affecting both users and operators. This piece explores the intricacies of such fraud, its far-reaching impact, and the innovative approaches to combating it, including location intelligence.

Subscribe to the Incognia Newsletter

Marketplaces used to be all about cash and cards—these days, they're also based on bits and bytes. Online marketplaces have become a haven for P2P, B2C, and B2B commerce, providing convenience, variety, and competitive pricing. However, this surge in popularity has not gone unnoticed by malicious actors looking for a quick payday.

Fraudsters are increasingly drawn to these platforms, especially peer-to-peer versions, exploiting their vast user bases and taking advantage of good users looking to strike a deal. Online marketplace fraud undermines user trust in the marketplace and its other users, lessening engagement and hurting profits for the marketplace owners.

Put simply, these marketplaces can only thrive if users have enough trust in them to put their money forward. Widespread fraud takes away that trust.

Safeguarding users from fraud and scams is paramount to a thriving online marketplace platform. With the right knowledge and tools, you can fortify your marketplace against fraud, ensuring trust and safety for all users.

Key TakeAways

- P2P marketplaces can be vulnerable to fraud like phishing, account takeovers, payment fraud, and scams

- This fraud impacts user trust in the marketplace and can damage a platform's retention and reputation

- User verification at onboarding and the use of next-gen risk signals can help protect marketplaces from fraud & abuse

Understanding marketplace fraud:

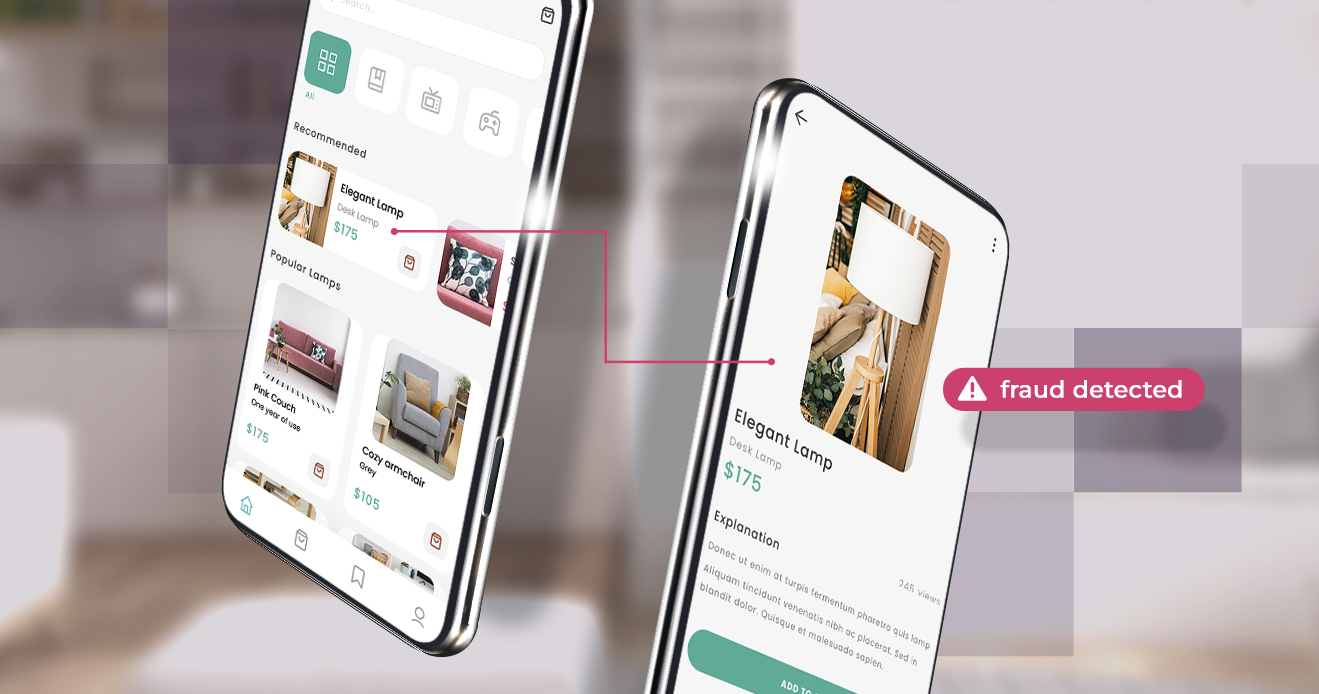

So, what exactly is online marketplace fraud? Online marketplace fraud refers to various deceptive practices carried out on internet-based platforms where goods and services are bought and sold. Fraudsters exploit these platforms to carry out illicit activities that can range from selling counterfeit goods, non-delivery of items, phishing for personal information, to payment fraud.

These wrongful acts are designed to deceive and take advantage of unsuspecting users, leading to financial loss and breach of personal security. The broad reach and anonymity provided by the internet often makes these fraudulent activities complex to detect and prevent, posing a significant challenge to maintaining the integrity and trustworthiness of online marketplaces.

Online marketplace fraud goes much deeper than the idea most consumers have of getting scammed. Most people are familiar with marketplace scams. You pay for something, and then you don't get it, or at least not the version of it that the seller advertised. This is certainly a prevalent form of marketplace fraud, but it's far from the only type.

Types of marketplace fraud:

Fraud on marketplaces can take a few different forms that both consumers and marketplace fraud prevention stakeholders should be aware of.

1. Phishing

Phishing is a form of online deception where fraudsters impersonate a reputable entity or person in order to gain sensitive information like login credentials, credit card numbers, and personal identification numbers.

In the context of online marketplaces, phishing typically occurs through false emails or fake websites. Fraudsters may send an email appearing to be from the marketplace platform, requesting users to update their account information or address a problem with their account.

Multi-Accounting: The Hidden Gateway to Marketplace Fraud

Similarly, they may create a counterfeit website to trick users into entering their login credentials or financial information. The damaging impact of phishing is profound—it not only leads to financial loss for the users but also severely undermines the trust in the marketplace platform. With the increasing sophistication of phishing techniques, it's becoming a growing challenge for online marketplaces to ensure the security of their users' information.

2. Scams

Scams are a common form of fraud on online marketplaces where malicious actors employ a variety of deceptive techniques to trick users out of money or goods. These scams can manifest in several ways, such as advance-fee scams where a user is asked to pay upfront for goods or services that are never delivered. Scammers might also post listings for non-existent products, enticing users with attractive prices only to disappear once payment is made.

Another prevalent scam is overpayment fraud, where the scammer overpays for an item with a fraudulent check or money order, then asks for the difference to be returned before the fraud is detected. When a chargeback is filed on the fraudulent payment the scammer made, it’s the victim left holding the bag with little way to recoup the money they “paid back” to the scammer.

3. Payment fraud

Payment fraud is another form of deception that has been increasingly plaguing online marketplaces. This involves fraudulent transactions where the scammer uses stolen credit card information or other illicit means to pay for goods or services.

Chargeback abuse, the act of reversing a transaction after the goods have been delivered, is another common form of payment fraud. This not only results in financial loss for the seller but also often leads to additional fees and penalties from payment processors. The anonymous nature of online transactions, coupled with the vast number of transactions happening daily, creates a fertile ground for payment fraud.

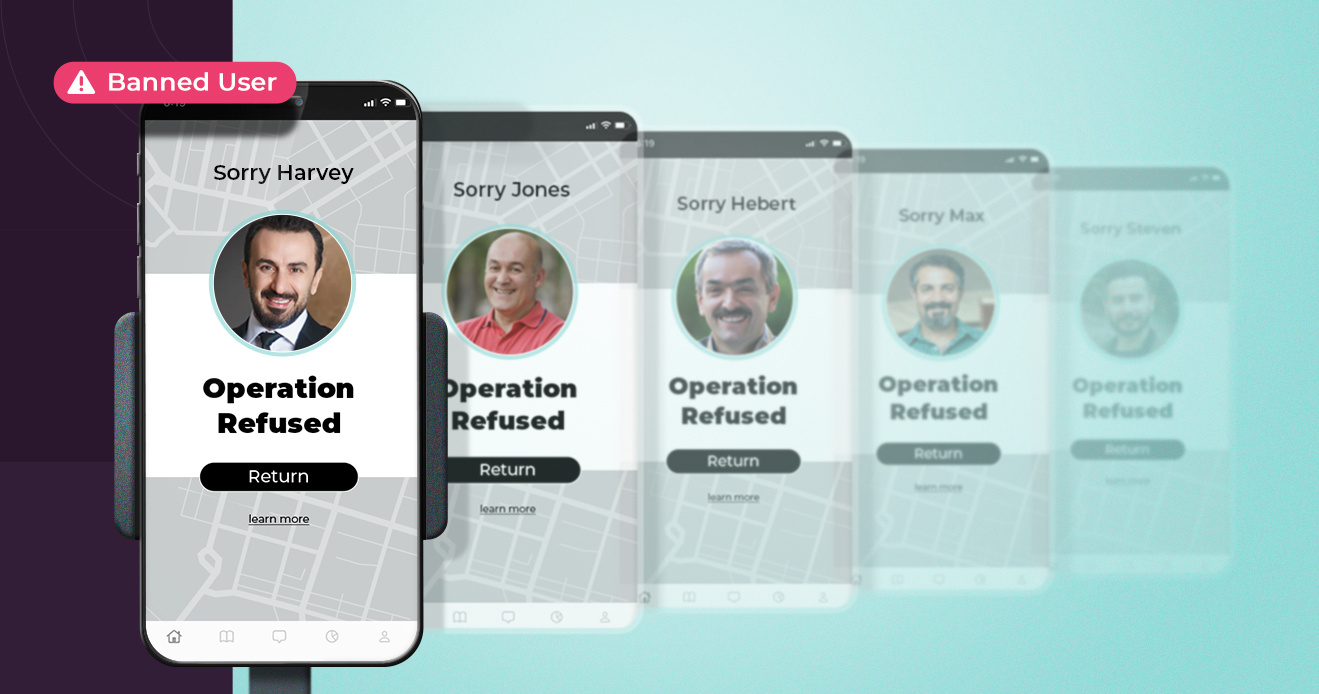

4. Account takeover

Account takeover is a form of identity theft where fraudsters gain unauthorized access to a user's marketplace account. This is typically achieved by obtaining the user's login credentials through phishing, data breaches, or by exploiting weak passwords. Once inside, the fraudster can make unauthorized purchases, change account details, and even lock the legitimate user out of their own account.

Moreover, account takeover can enable a scammer to exploit the trust factor established by long-term users of the marketplace. They can utilize the good reputation of a high-rated account to post misleading listings, conduct scams, or dupe other users into fraudulent transactions.

This not only causes significant financial damage to the victimized user, but also severely harms the trustworthiness of the platform, undermining the confidence of other users. Due to the anonymity of online transactions, tracking, and prosecuting these fraudsters can be challenging, making account takeover a serious threat to the security and integrity of online marketplaces.

The impact of marketplace fraud

The consequences of marketplace fraud are far-reaching and multi-dimensional, encompassing financial losses and reputational damage. Financially, fraudulent transactions result in significant losses for both marketplace users and operators.

Users may lose money through scams, unauthorized charges or undelivered goods, while marketplace operators may face considerable expenses in refunding fraudulent transactions, not to mention the costs involved in fraud detection and prevention measures.

However, the implications of fraud go beyond monetary losses. At the heart of every successful online marketplace is the trust between users and the platform. When fraud occurs, this trust is breached, leading to a decline in user confidence. Users may hesitate to interact with the platform due to fear of falling victim to scams or identity theft, leading to decreased activity and transaction volumes.

Moreover, frequent occurrences of fraud can tarnish the reputation of the marketplace. Negative user experiences, especially when amplified through social media and online reviews, can lead to a wider perception of the marketplace as unsafe or unreliable.

This reputation damage can be enduring and difficult to repair, leading to reduced user acquisition and retention rates, and ultimately, impacting the sustainability and growth of the marketplace. The fight against marketplace fraud, therefore, is not just financial, but also essential for maintaining user trust and preserving the marketplace's reputation.

The role of location in combating marketplace fraud

How are online marketplaces fighting back against fraud today? Alongside traditional fraud prevention methods like multi-factor authentication, identity verification at onboarding, and automated seller fraud detection, user education is another focus.

For example, some platforms have banners that display at the beginning of every new seller and buyer interaction reminding buyers to be wary of scams. The fact of the matter is, however, that users can’t be expected to stay up to date with every new fraud and scam vector that develops—and other tools like MFA and automated fraud detection, while helpful, may not be doing enough to protect marketplace integrity on their own.

While there’s no silver bullet for marketplace fraud prevention, location intelligence can provide marketplace operators with a powerful risk and authentication signal. At onboarding, real-time address verification can be used to verify the accuracy of user-provided identifying information, including location. If someone lies about their location at onboarding, that indicates higher risk of fraudulent intentions.

For geo-restricted marketplaces, location intelligence can also be used to ensure that people only see posts from other users that are actually in their geographic range. Incognia’s location technology is also resistant to GPS and IP address spoofing, meaning that fraudsters won’t be able to change or mask their true location to skirt around the platform’s checks.

Because Incognia’s location technology is so precise, it can also be used as a passive authentication factor with low false positives. The way people move throughout the world is unique, just like a fingerprint—using this location fingerprint as an additional authentication factor can help safeguard accounts against account takeover attacks without increasing user frustration.

In this case study, we showed how we were able to authenticate 45.5 million logins with 0 reported instances of ATO using location.

Fraudsters stay on the bleeding edge of their craft to stay ahead of educated consumers, fraud prevention teams, and law enforcement. To protect marketplace users and platforms from bad actors, innovative approaches to assessing risk and identifying users are paramount. Location intelligence is just one example of an online marketplace fraud signal that’s staying one step ahead of the fraudsters.

To learn more about what Incognia is doing to help secure P2P marketplaces, visit our industry page here.