- Blog

- New Crypto Edition of Mobile App Friction Report

New Crypto Edition of Mobile App Friction Report

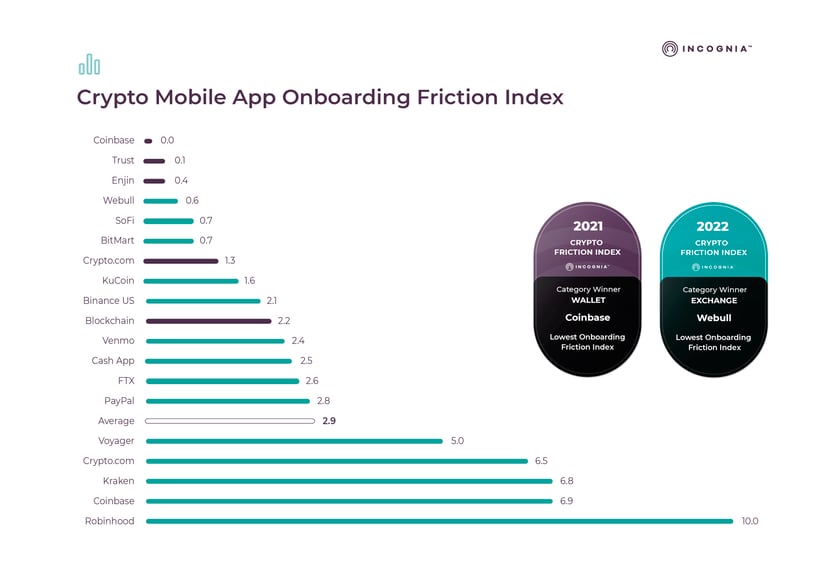

Review of 19 top crypto mobile apps including Coinbase, Binance, Kraken, Robinhood, Webull and others

Subscribe to the Incognia Newsletter

Cryptocurrency has drawn widespread attention recently, and not just from investors, but also from fraudsters and cybercriminals. Downloads of Crypto mobile apps hit a peak in 2021, with the number of cryptocurrency users now estimated at more than 300 million. Along with the increased adoption of cryptocurrency has been an increase in crypto-related fraud, with over $14 billion of funds in crypto accounts in 2021 being linked to the crime. Already in 2022, there have been several high-profile cryptocurrency thefts including $30M stolen from user accounts at crypto.com, the wormhole cryptocurrency platform hacked for $325M, and $80M of cryptocurrency stolen from the Qubit DeFi platform. Cryptocurrency stolen by fraud schemes is the largest contributor to cryptocurrency theft, followed by cryptocurrency stolen directly from exchanges. With fraudsters following the money, Crypto mobile apps have to up their security game if they intend to win the fight against fraud.

A Review of Crypto App Identify Verification and Authentication

Incognia today announced a new Crypto edition of its Mobile App Friction Report. In this report, are the results from Incognia’s review of the onboarding process of 19 of the top mobile crypto apps, including both wallets and exchanges, from companies such as Coinbase, Binance, Kraken, Robinhood, Enjin, Webull, Crypto.com, and others.

We wanted to review how Crypto apps were balancing the requirements of demonstrating compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations and onboarding new users as quickly as possible. Included in the report is a comparison of the identity verification and authentication techniques used by each app during onboarding and how the apps ranked for onboarding friction.

And the winners are Coinbase Wallet and Webull Exchange

[banner_1]

Coinbase Wallet and Webull Exchange had the lowest onboarding friction by requesting a minimum of information from the user and making use of progressive onboarding techniques to reduce the time to create an account. Robinhood in contrast had the most comprehensive identity verification during onboarding and consequently had the highest friction.

Sources of Friction at Onboarding

In reviewing the identity verification and authentication methods used by the crypto apps for onboarding, it appears that the apps are prioritizing the delivery of a streamlined user experience and minimizing the steps required of the user, and in the process are missing the opportunity for enhanced fraud detection.

Uploading of documents for identity verification is a particularly high friction experience and it is notable that only five of the fourteen exchanges asked for users to upload a driver’s license.

Address validation - a missed opportunity for fraud detection

While ten of fourteen exchanges required the new user to input declared address information and four apps required the input of country of residence or ZIP Code, none of the nineteen apps required the user to upload a document such as a utility bill or credit card statement and none requested permission to make use of geolocation information from the device for fraud prevention.

The use of geolocation signals for real-time address validation is an opportunity to improve KYC and fraud detection with no added user friction. While other Financial and Fintech Apps are using location as a fraud prevention measure, Crypto apps still have some room to improve their fraud detection by incorporating location signals.

To read a full review and analysis of the identity verification methods and friction for each app, download the full report here - Crypto Edition - Incognia Mobile App Friction Report.