- Blog

- Why Incognia when considering behavioral biometrics

Why Incognia when considering behavioral biometrics

Location behavior offers a compelling authentication signal in banking and financial services

Subscribe to the Incognia Newsletter

Authentication controls and fraud detection presents a uniquely complex challenge for banking, financial services, and insurance companies (BFSIs). These sectors require a layered security approach across multiple channels including mobile, web, in-branch, and call center. Today, over 70% of customers at the top four US banks are mobile app-enabled. With user demand for mobile banking only continuing to grow amongst millennials and younger generations, banking and financial services companies recognize the significant market opportunity that mobile presents to attract new customers and drive high customer satisfaction. Customers expect both a secure and frictionless mobile app experience, whether they are simply checking their account balance, performing a money transfer, or using bill pay. With mobile app usage surging during the pandemic, mobile fraud rates are also steadily rising. For banking and financial services, traditional authentication controls and static fraud data are often not enough to protect their customers on mobile.

Banks and other financial services organizations continue to add innovative security layers

With steady innovation in the identity space over the past decade, authentication and fraud teams have had the opportunity to explore multiple new strategies for modernizing their technology stacks. Behavioral biometrics has offered several compelling features, including no user friction, continuous security, adaptation to user behavior over time, and the promise of high accuracy and identity assurance. According to Biometric Update, almost a third (32 percent) of financial institutions are planning to adopt behavioral biometrics within the next 18 months.

BFSIs have found success with behavioral biometrics in certain authentication and fraud use cases, such as bot detection during new account opening and account takeover protection.

Where have traditional behavioral biometrics fallen short in BFSI?

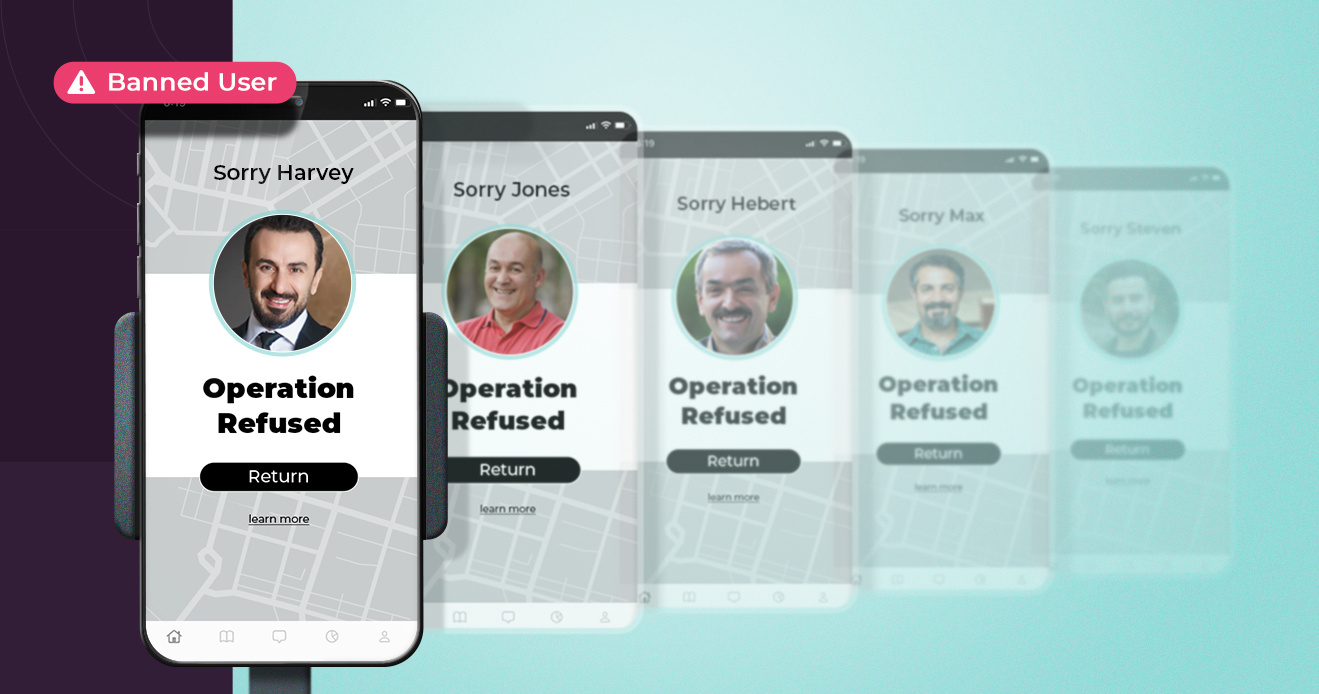

While more traditional behavioral biometrics (e.g., mouse and keystroke patterns, touchscreen behavior, device movement, etc.) can deliver value in certain use cases, the technology can present some important challenges for many authentication and fraud teams:

- Time to Value - For authentication use cases, training behavioral biometric models requires an extended period of time of observable user behavior over numerous sessions. Without this training, these solutions are unable to adequately learn a user’s behavior and provide accurate identity assurance. In some cases, model training can take months before the behavioral signal is strong enough to be considerable reliable

- Implementation & Maintenance - Behavioral biometrics can be expensive and resource-intensive to implement and maintain, often necessitating hours of professional services, resulting in increased costs and resources required to work with the vendor

- Black Box approach - Behavioral biometric solutions are frequently described as “black boxes” that are not easily configurable or customizable by authentication and fraud teams. This perpetuates the need for additional professional services and can present challenges for the BFSI to fully automate the solution. Many times the data generated by these black boxes is not shared with customers.

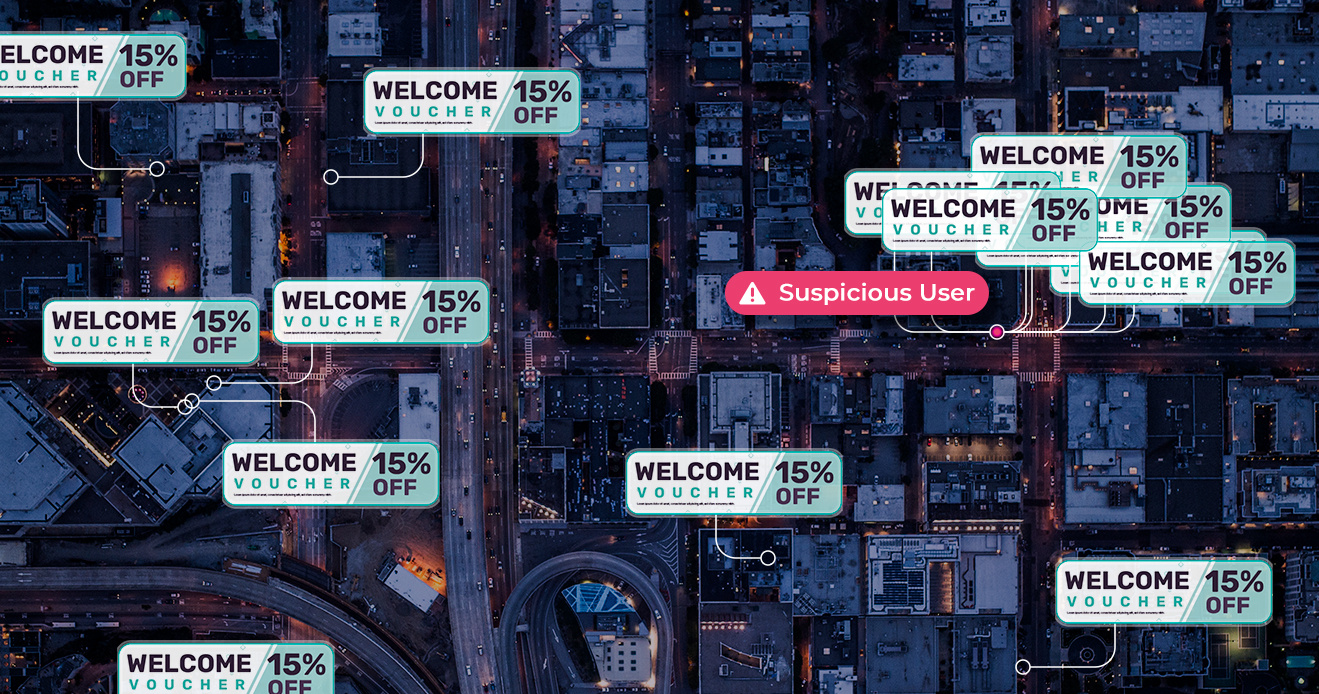

Why location behavior is a compelling, additional layer in your modern authentication and fraud stack

For teams looking to innovate and modernize their technology stacks with a focus on mobile, Incognia offers a compelling additive signal that provides faster results with more precision. With 75% of the top 50 finance apps already requesting location permissions, a large percentage of banking and financial services companies are already set up to take advantage of Incognia’s advanced location behavior solution. Built over the past decade, Incognia enables BFSIs to realize the same value sought after with traditional behavioral biometrics (strong passive signal, continuous security, high accuracy) without the same obstacles and challenges.

Incognia’s modern authentication and fraud signal for banking and financial services teams are:

- Mobile-first, while also extensible to other channels such as web login, in-branch, and call center

- Privacy-preserving, with zero PII collected and all location information anonymized

- Easy to integrate, mobile SDK and API allow organizations to realize day one intelligence

- Flexible and transparent, authentication and fraud teams can leverage all or part of Incognia’s risk assessment and evidence, based on what makes sense for your risk model

To learn more about Incognia's innovative location behavior solution, read more here.