White Paper

Financial Services Guide

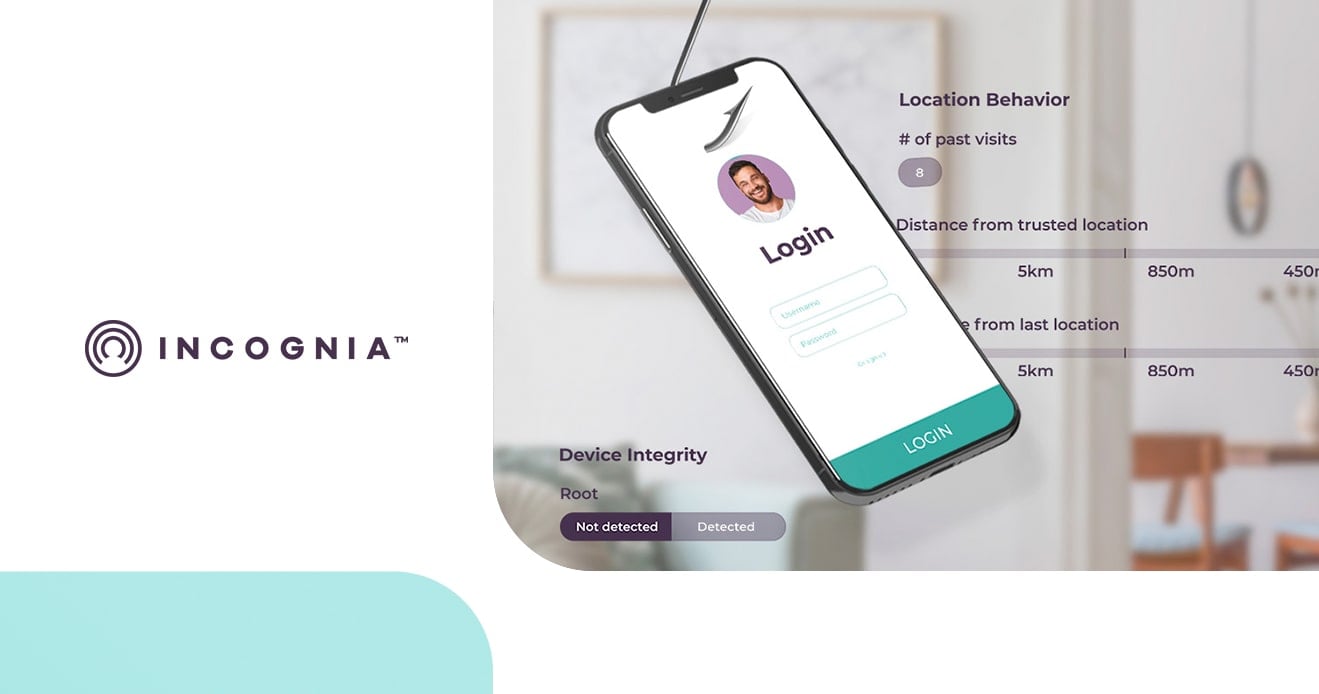

Enabling frictionless fraud prevention for mobile users

Download this whitepaper to learn:

- The latest techniques cybercriminals are using to bypass mobile security

- Recommendations for how to balance fraud prevention and friction for mobile users

- The benefits of location behavioral biometrics for frictionless authentication and Identity verification