"Incognia reduced the cost of our app authentication flow by 51%. With Incognia, the app decreased the reliance on high-friction facial biometrics and improved our customers' in-app experience while ensuring our processes' safety.”

A leading digital bank was relying on four different credit bureaus to verify users’ addresses during onboarding. Even so, at least 29% of the applications would still go to manual review, resulting in a 70% application drop off.

With more than 60% of global consumers now adopting FinTech1, the importance of offering online banking and mobile-first services is rising for all types of financial institutions. Offering better financial services and delivering a first-class customer experience has helped challenger banks gain market share. Traditional banks have taken note, with many launching digital banks of their own.

While this is happening, identity verification is also being redesigned to support mobile banking. Asking a prospective customer to upload a copy of identity documentation introduces a substantial amount of friction into the onboarding process. At the same time, using credit bureaus alone to check the personal information is not enough, especially as fraudsters develop new identity theft techniques. Without a solid solution, customer acquisition costs and fraud risks increase. Mobile banks need ID verification solutions that are automated, accurate and frictionless so that they can convert good users faster.

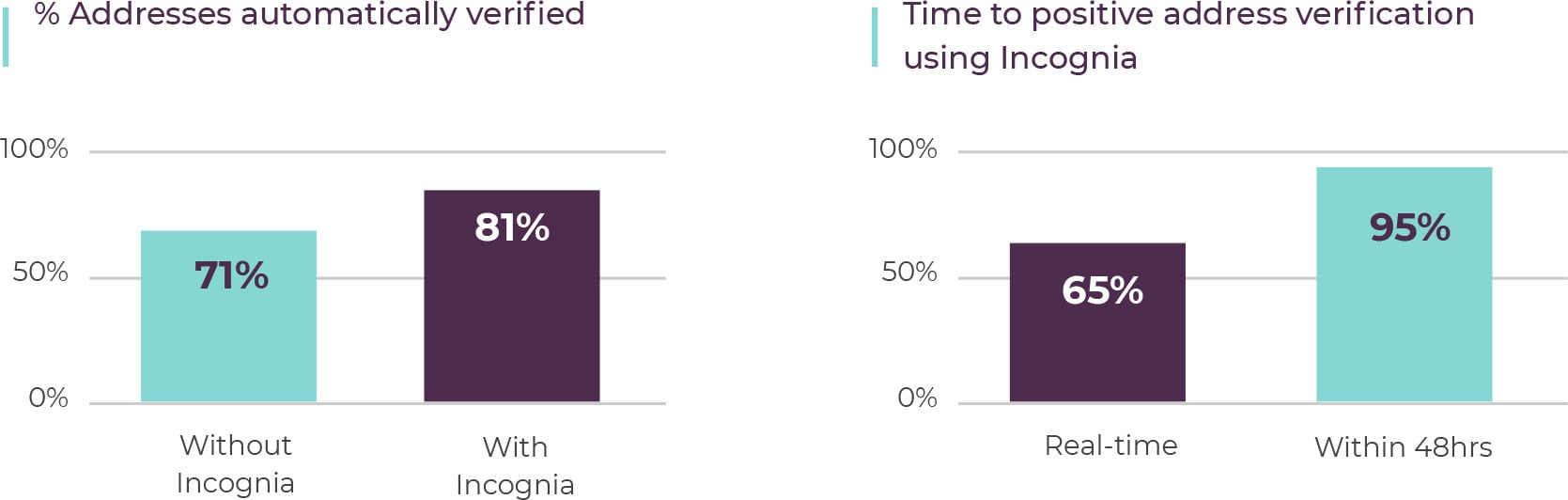

Incognia partnered with a digital bank to improve their identity verification process by increasing the number of addresses verified automatically. This bank relied on four credit bureaus to verify identities for new mobile users, but found that only 71% of prospective customers applying on mobile could be automatically verified using this approach, leaving the other 29% to be manually reviewed. Not only did this manual review technique introduce high friction for users, but also resulted in a 70% drop off of new applications. The executive team needed to find an quick to deploy technology solution to reduce the friction of mobile onboarding and improve operational efficiency, and top line growth.

The bank was interested in using Incognia to supplement their existing identity verification process to increase the real time approval rate of addresses and reduce manual reviews. Incognia was able to match the home addresses provided by new users at onboarding with the location behavior history of the device used to apply

The digital bank integrated Incognia into its mobile onboarding process to automate mobile identity verification using location behavioral biometrics. The Incognia solution matches device behavior to the address provided by the new user to automatically verify addresses, without adding friction to the user.

During a 25 days period, the bank checked 449,000 new accounts using Incognia. With the addition of Incognia, the bank was able to automatically approve 81% of all new addresses received during this period.

173,000 (65%) of the new addresses were instantaneously positively verified by Incognia, reducing the friction and time to onboard trusted customers. Incognia was also able to block 13,000 new accounts in real-time, due to suspicious or malicious location behavior.

In addition to verifying new users faster with Incognia, the bank was also able to reduce by 18% the number of manual reviews. This result helped the bank reduce the costs of manual reviews as well as increasing conversions, and reducing the new application drop off rate.

Finally, by increasing automatic identity verification and reducing the number of manual review, the bank was able to reduce by 11% the overall onboarding cost and cost per user.

Achieve 81% automatically approved addresses

Reduce the number of manual reviews required by 18%

Approve 65% of the addresses instantaneously, in real time

Reduce by 11% the overall onboarding cost and cost per user

One of our specialists will be glad to meet you and go over Incognia's capabilities.

To help us personalize our conversation for your business, please fill out the following form.